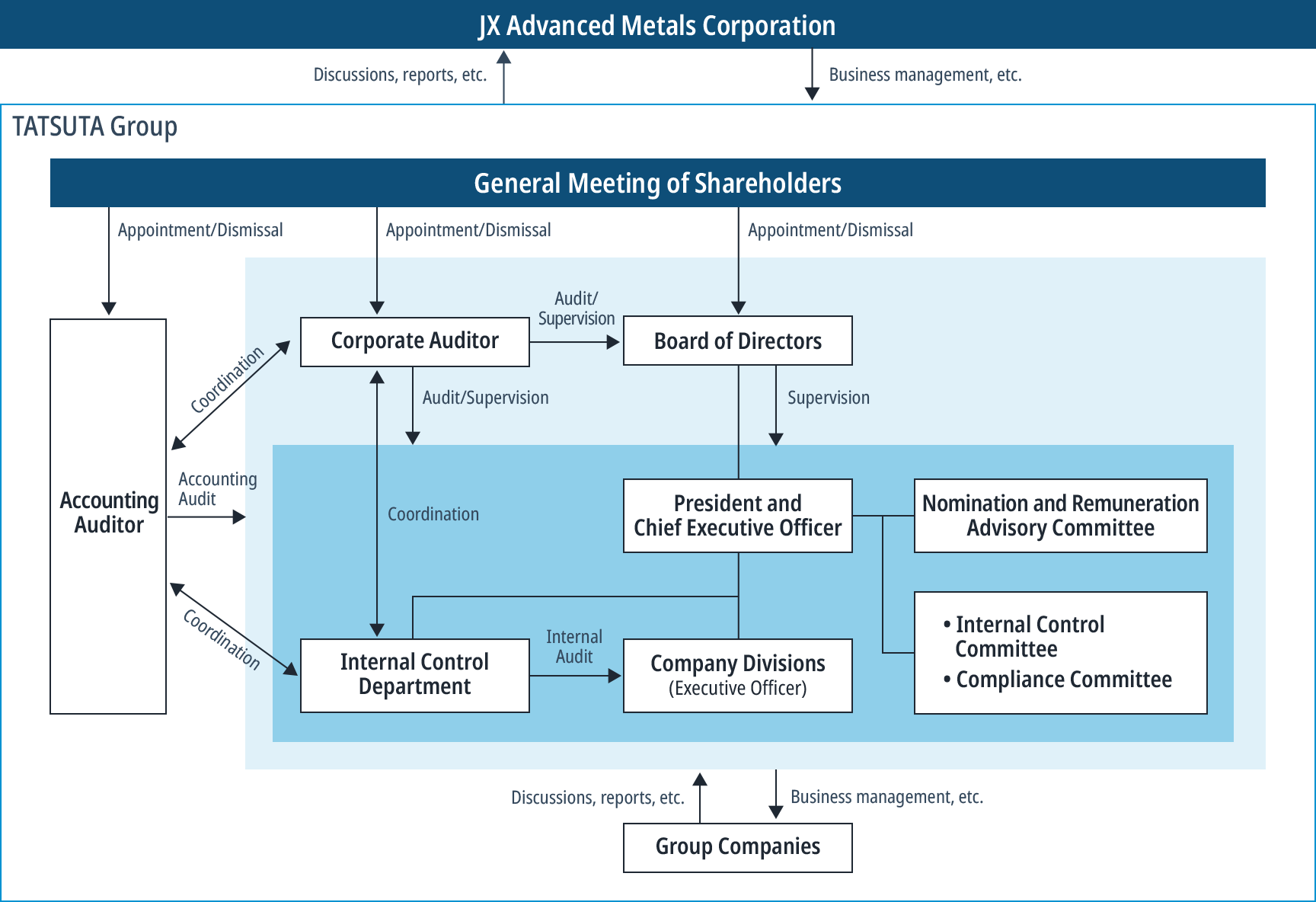

Corporate Governance Structure

At the TATSUTA Group, we are endeavoring to strengthen corporate governance in order to achieve sustainable growth and enhance corporate value in the medium and long term, while ensuring swift decision-making as well as sound and transparent management.

TATSUTA’s Board of Directors, Board of Managing Officers, and other management bodies make decisions on important matters, etc. We have also set up a range of governance-related committees, which are tasked with coordinating with and supervising each other. We have established the Basic Policy on Internal Control Systems, and set out the division of duties of various governance tasks and organizational structures by resolution of the Board of Directors.

Promotion system

Corporate Governance Structure

Board of Directors

The Board of Directors is responsible for promoting TATSUTA’s sustainable growth and medium- and long-term corporate value enhancement and endeavoring to improve earning ability and capital efficiency, based on its fiduciary duty and accountability to shareholders. In addition to deciding on matters designated by laws and regulations or the Articles of Incorporation, the Board of Directors formulates medium-term management plans and other plans such as fiscal year budgets, manages differences between plans and results, and instructs Executive Officers in countermeasures, as necessary. Furthermore, the Board also creates an environment to support appropriate risk-taking by Executive Officers and supervises the execution of duties by Directors and Executive Officers.

Executive Officer System

Executive Officers efficiently execute business operations based on the basic policies determined by the Board of Directors.

- For inquiries about ESG